COVID-19 and cash flow for independent practices

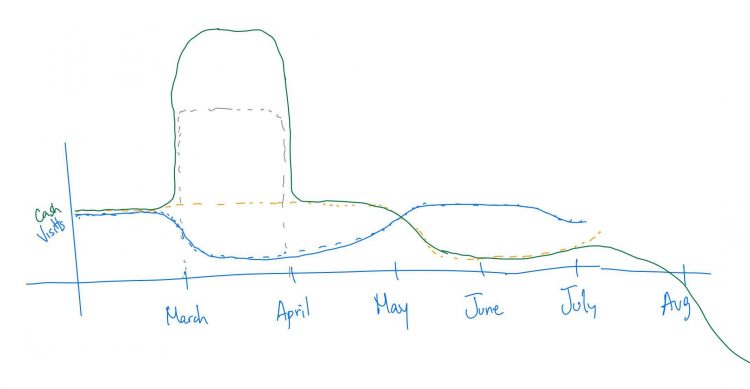

Let’s talk cash flow. With the complexity of medical billing in the US, independent primary care medical practices are likely just now feeling the real cash hit of the COVID-19 crisis.

Why now? To start, there’s a standard 45-90 day lag from when a patient is seen in a medical practice to when the practice actually gets paid from health plans and CMS.

It’s tough for small practices to predict how this reimbursement shakes out, something companies like OODA are trying to help with.

Reimbursement for telehealth has also been a hurdle. Nearly 1-in-5 telehealth bills is being denied according to the latest from PCPCC, despite promises for parity with in-person care during COVID-19.

Telehealth, which helped get so many practices through the pandemic so far, is slowing down, too. May 4 was the peak for telehealth visits with Elation Health’s PCP community, with a 15% drop since then.

Will this tough quarter be a blip on a medical practice’s cash flow or the start of something more alarming? It could go either way.