Elation is here to help you address COVID-19 with your patients

In response to the growing concern around COVID-19 in the United States, our team wanted to share a few ways in which your practice can leverage Elation to reach out to your patients en masse.

Whether your objective is to share prevention recommendations or latest news, Elation’s built-in messaging functionality will allow you to push announcements to your patients to ensure they have the information they need to stay healthy.

Using Elation’s Bulk Letter feature to reach out to your patients

Bulk Letters allows you to send personalized messages to all patients who have registered Passport accounts.

For any patients without Passport, the feature gives you the option to bulk invite these patients to Passport, print out a PDF copy of your message for these individuals, or exclude them from the recipient list.

For HIPAA compliance reasons, you are not able to send messages directly to a patient’s email from within Elation. However, if you’d like, you can download a spreadsheet of patient email addresses from our Patient List to email them outside of Elation (instructions for downloading the spreadsheet can be found at the bottom of this article).

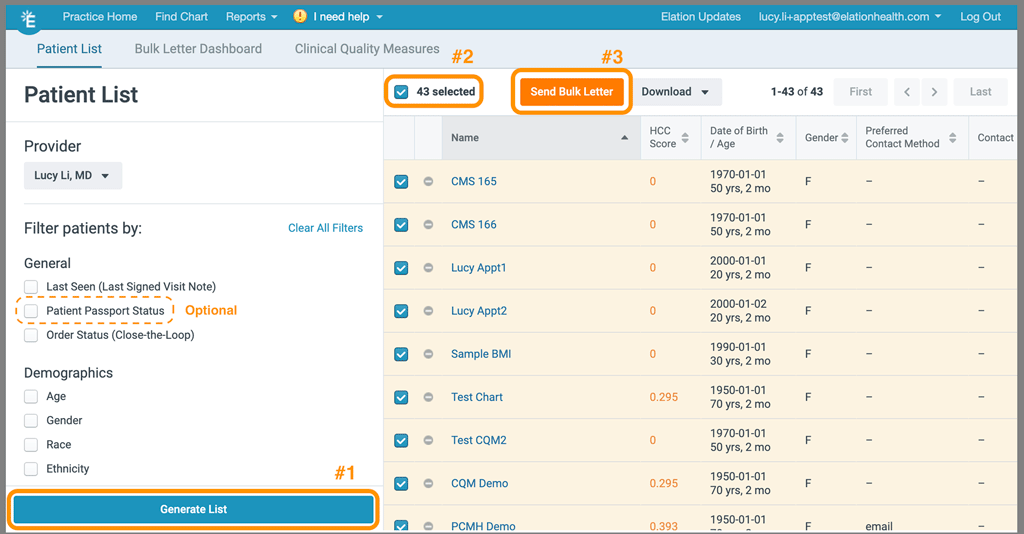

- Run a Patient List to see all patients in your panel.

- If you would only like to see patients with Passport accounts, you can check-off the “Patient passport status” filter and choose “Registered users”

- Once your Patient List is generated, check the box for “Select All” and click “Send Bulk Letter”

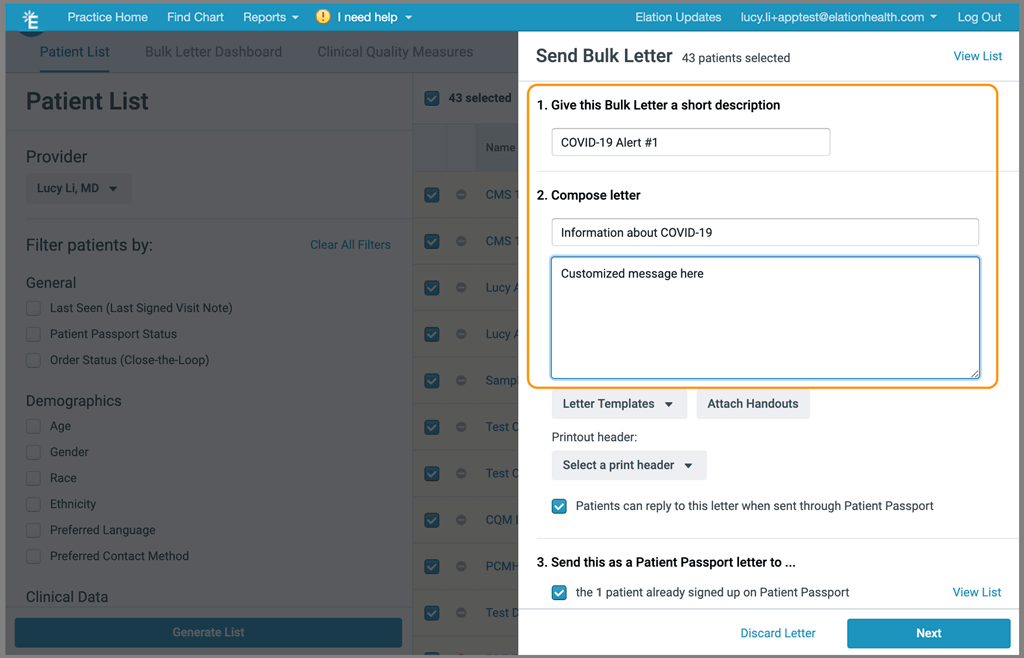

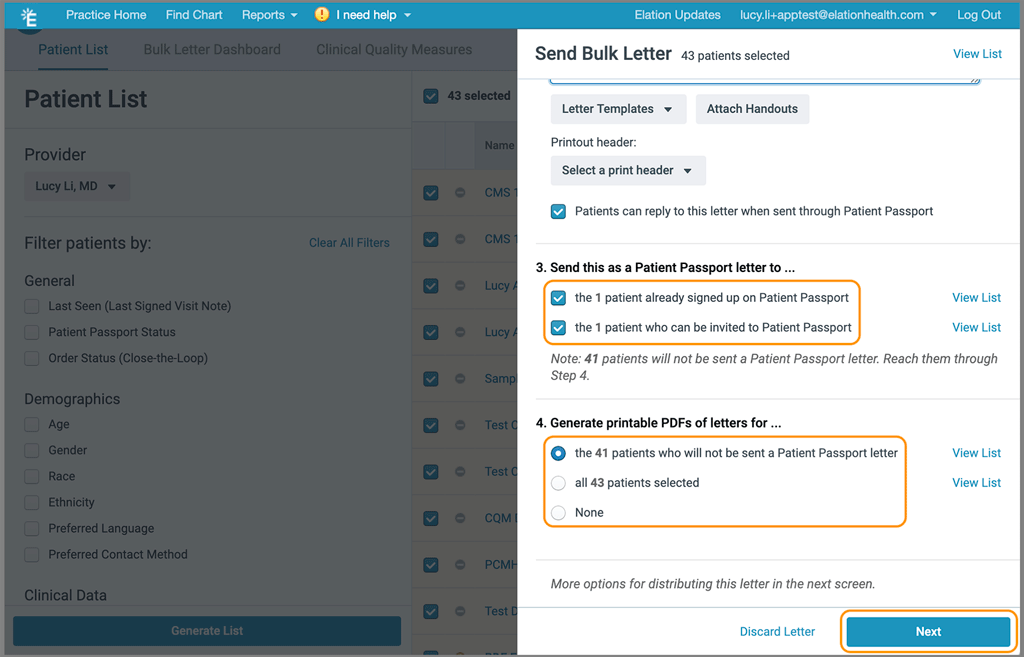

- Complete the Bulk Letter form to the right of your screen and click Next.

- Under Step 3, you can specify how you’d like to handle the Letter for patients without Passport accounts.

- Under Step 3, you can specify how you’d like to handle the Letter for patients without Passport accounts.

- Review the confirmation page and click “Send Bulk Letter”

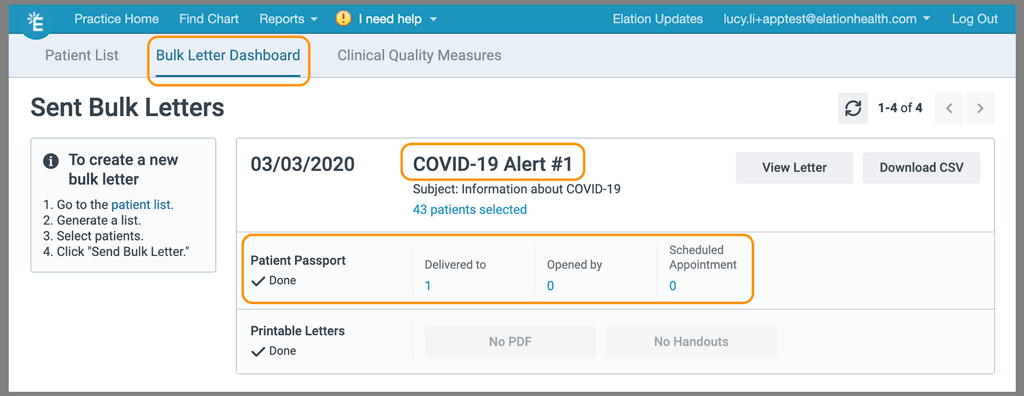

- You’ll be redirected to a Dashboard view where you can track who has received and opened your message.

For more instructions please visit our help center article on Bulk Letters.

Again, for HIPAA compliance reasons, you are not able to send messages directly to a patient’s email from within Elation. To export a spreadsheet of patient email addresses:

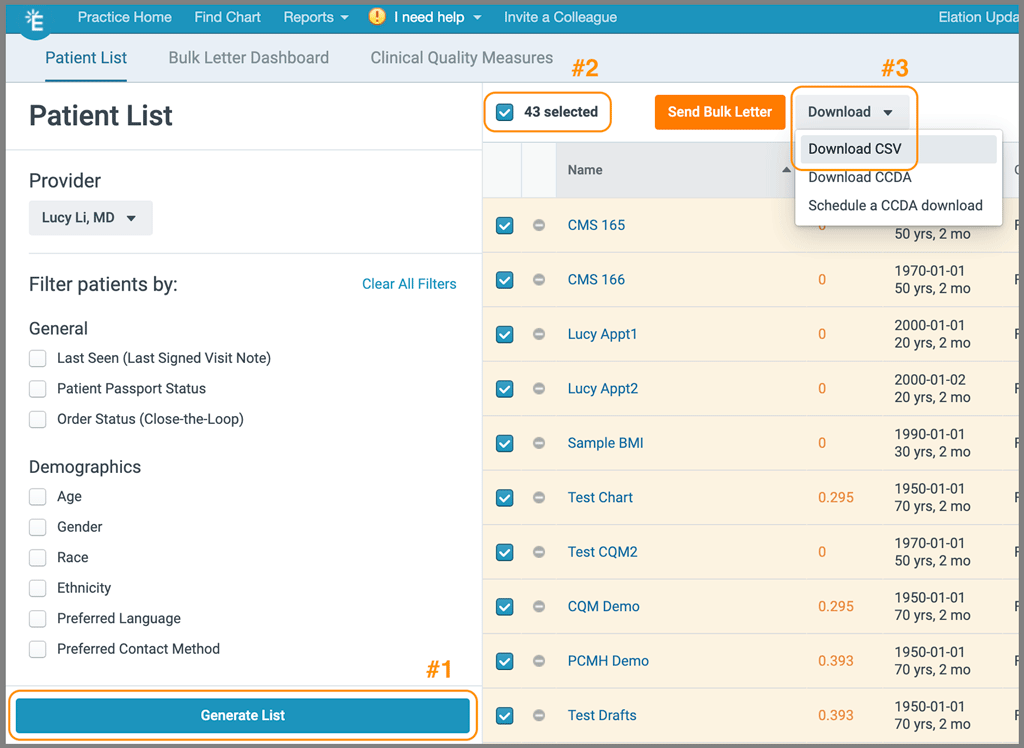

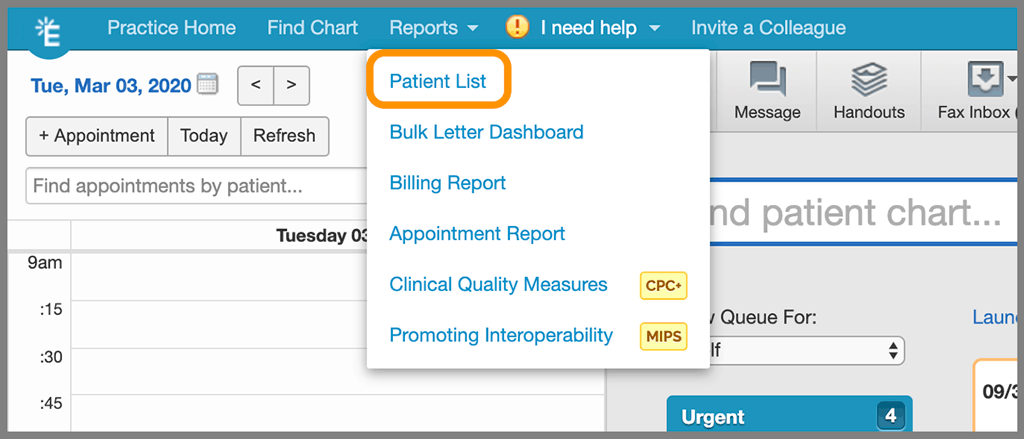

- Go to “Reports > Patient List”

- Generate a list of your patients

- Check “Select all”

- Click “Download > Download CSV”